Retrieval-Augmented Generation (RAG) Pipeline for Financial Data Analysis

AI RAG LangChain LLM Finance

Overview

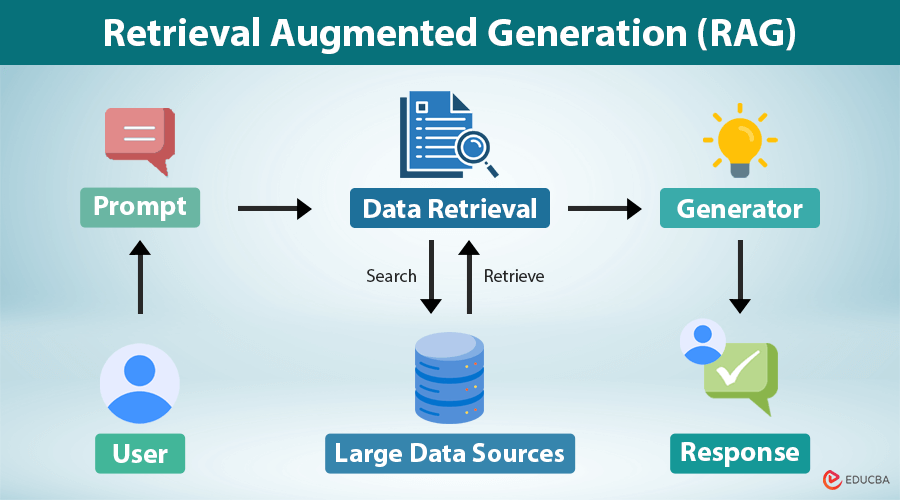

Large Language Models are powerful, but on their own they lack access to private, up-to-date, or domain-specific financial data.

This project solves that limitation by building a Retrieval-Augmented Generation (RAG) pipeline that grounds LLM responses in relevant financial documents.

The system allows users to ask natural-language questions about financial concepts, companies, or reports and receive context-aware, explainable answers sourced from real data rather than hallucinated knowledge.

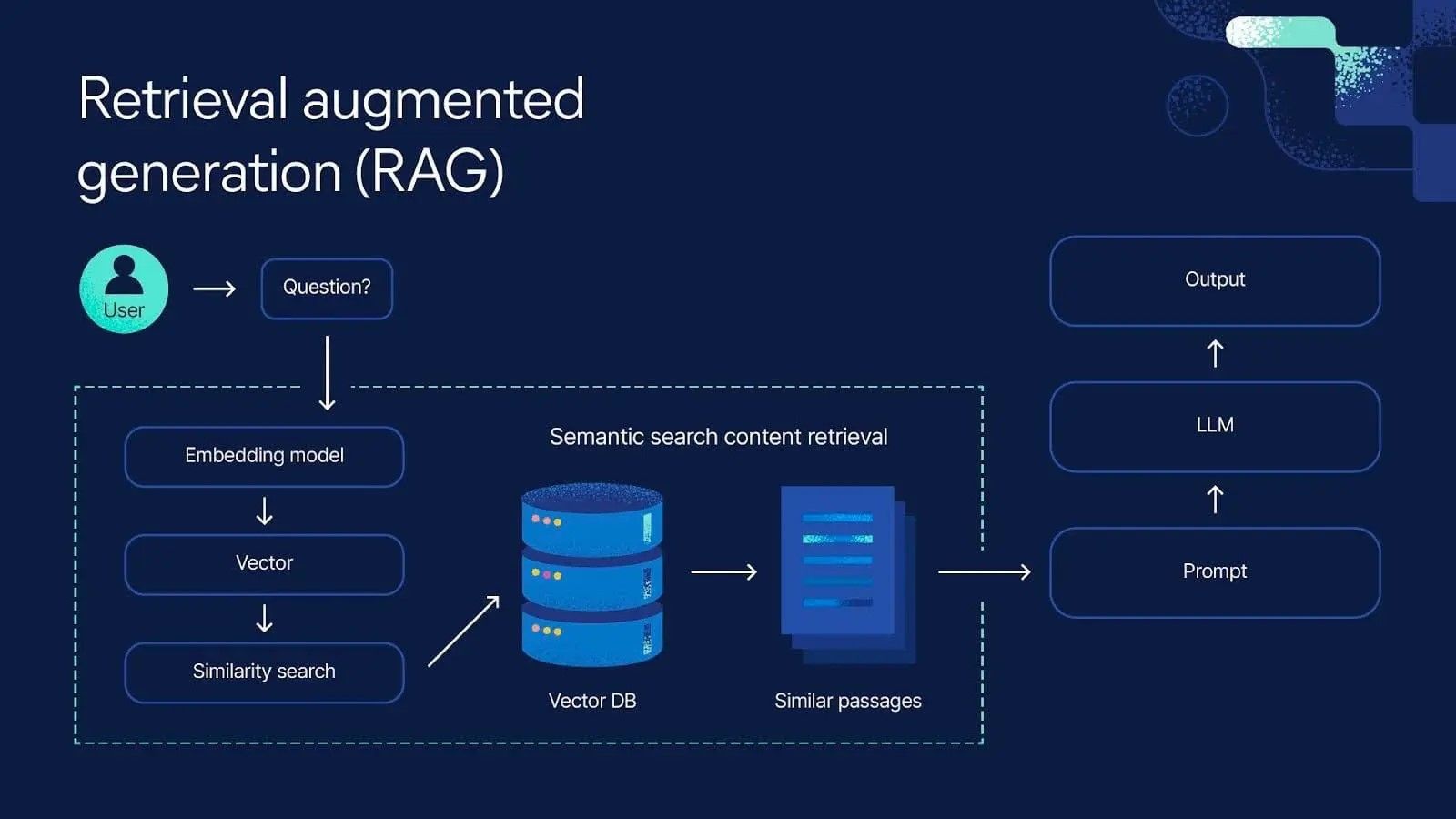

High-Level Architecture

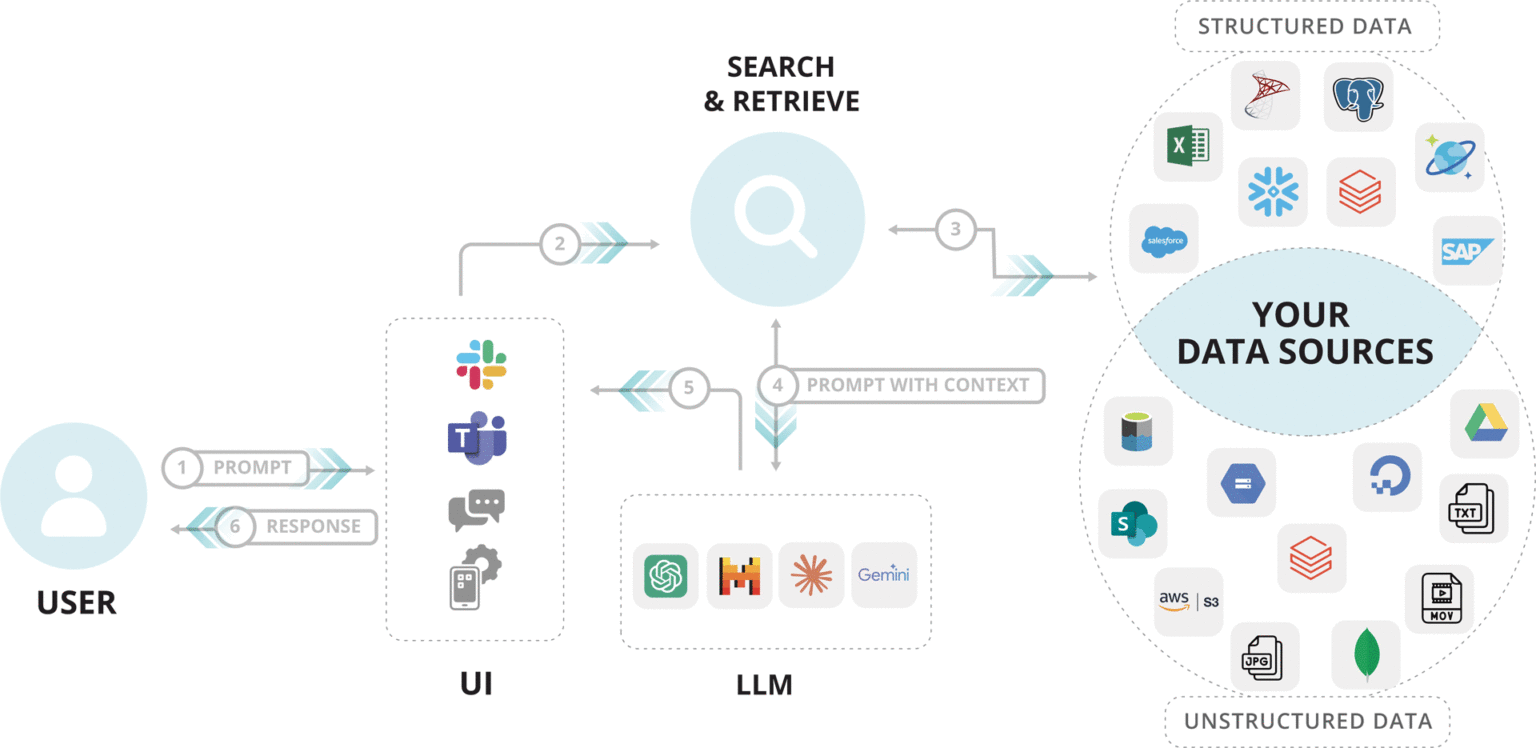

At a high level, the system combines:

- A frontend that captures user queries

- A LangChain agent that orchestrates reasoning and tool usage

- A vector database for semantic document retrieval

- An LLM that generates grounded responses using retrieved context

Step-by-Step Flow (Simple View)

- User asks a question (e.g., “What is EBITDA?” or “Explain recent earnings trends”)

- The query is sent to a backend Python FastAPI service

- The query is embedded and matched against a vector database

- Relevant document chunks are retrieved

- The LLM receives both the question and retrieved context

- A context-aware answer is streamed back to the user

Agent & Tooling Logic

The LangChain agent decides dynamically:

- Whether a tool is required (search, retrieval, calculator, etc.)

- Which documents are relevant

- How to structure the final response

Key Design Choices

- Tool Calling: Enables retrieval, calculations, and reasoning

- Memory: Maintains conversational context across turns

- Streaming Responses: Improves UX by returning partial answers in real time

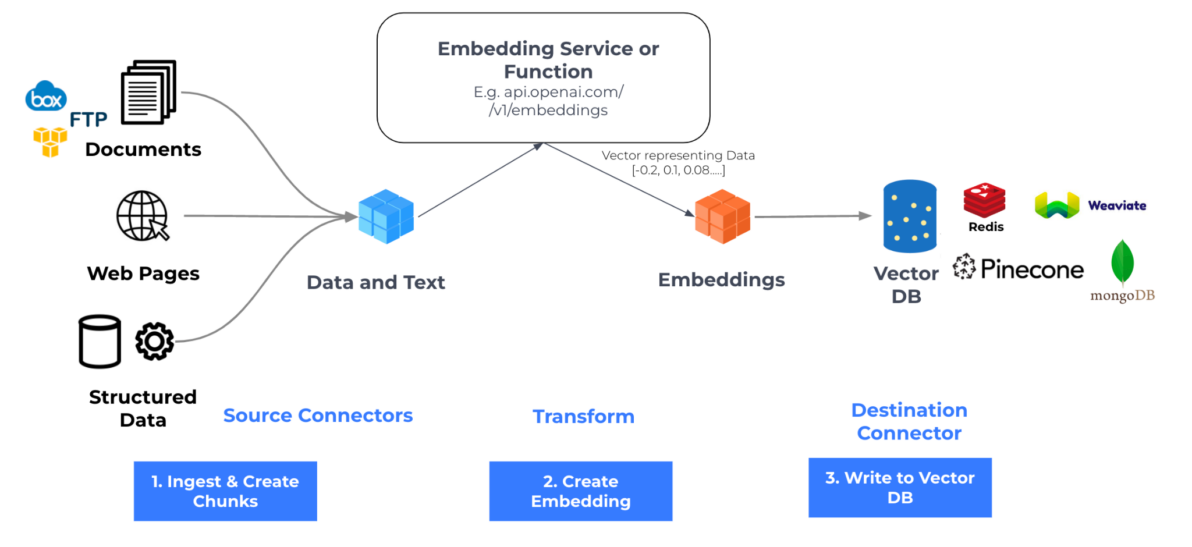

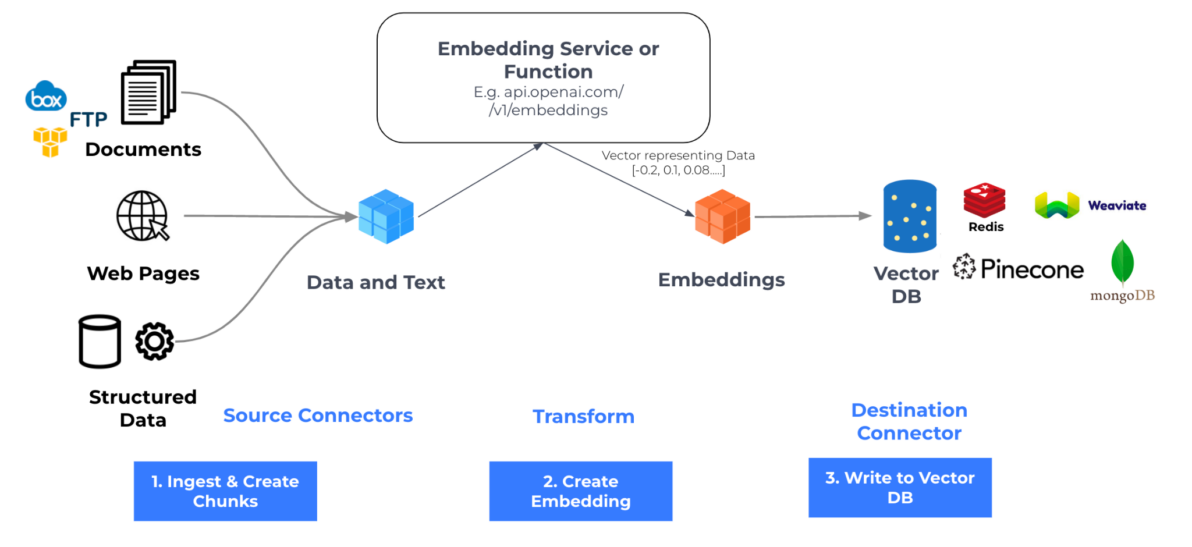

Vector Search & Retrieval

- Financial documents are split into chunks

- Each chunk is converted into vector embeddings

- Queries are embedded and matched using semantic similarity

- Only the most relevant chunks are passed to the LLM

This ensures answers are grounded in real data, not just model intuition.

Why RAG Matters for Finance

Traditional LLMs:

- Cannot access private financial documents

- Hallucinate facts

- Struggle with up-to-date market data

This RAG pipeline:

- Grounds answers in real financial sources

- Improves accuracy and trust

- Scales across reports, filings, and research notes

- Enables explainable AI for finance use cases

Key Features

- Context-aware financial Q&A

- Semantic document retrieval using embeddings

- Tool-based agent reasoning

- Streaming responses for better UX

- Modular and extensible architecture

Tech Stack

- Language: Python

- Frameworks: LangChain, FastAPI

- LLM: OpenAI API

- Vector Database: FAISS / ChromaDB

- Concepts: RAG, Tool Calling, Memory, Embeddings

Links

- GitHub Repository: https://github.com/ashik-ms/langChainAgent